How do I Value My Budapest Property?

How do I Value My Budapest Property?

When the Irish desire for property, particularly overseas, was at the boomiest of its boominess, the most popular new market to which the Irish gravitated was Hungary’s capital, Budapest. If you’ve visited you’ll know why. It is a seriously gorgeous and seductive city. Beautiful architecture abounds, the famed Danube splits the city into its Buda and Pest sides, the city’s well-documented baths lure visitors to return time and again and it’s willowy citizenry are a constant source of attraction to the curious Irish mind.

Of course all of this is worth nought when it comes to investing in property. If you want to keep making money then there has to be a mature rental market, there never was a large enough one in Budapest to keep all the balls in the air so, inevitably, profit had to be garnered from playing a high-propane game of pass the parcel. Unfortunately this is a game in which the holder of the parcel when the music stops is the loser. So it was with a large tranche of Irish owners in Budapest. They are now property owners there by default because the buck has stopped with them. The city initially offered ‘cheap’ investment options then it went through its own turbo-charged boom and bust cycle, leaving a lot of parcel holders in its wake. Many of these parcels are also now worth a lot less than what was paid for them originally although, to be fair, investors in Hungary are faring a lot better in general than those who bought property in Ireland, a lot of which is, if it ever got built, now virtually worthless.

Seeing as the Irish media was one of the prime drivers of this overseas property buying splurge, you’d imagine it would be very anxious to follow up and advise its readers on how to manage their investments. No such luck. No advertising revenue from the sector that drove historic profits in the newspaper industry means that this is, apparently, too much to ask. If you are an overseas property owner the media industry now wishes to bracket you with banks, property developers and Fianna Fáil as a throwback to an era of excess that it now wishes to sweep under the carpet. Hence the popularity of websites such as this one. These owners have to get information somewhere.

The obvious question for those looking to move on their Budapest properties is how exactly do you go about valuing this property now that the market has stabilised somewhat?

According to Budapest based Hungarian real estate website, Realdeal.hu, because of the lack of a genuine multiple listing service and other peculiarities of the local property market, one of the biggest ongoing sources of tension for property owners in Budapest is never really having a realistic idea of what properties are worth. The other is how likely their properties are to be burglarised. How charming.

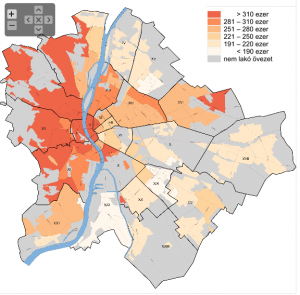

The site’s blog says a new series of maps compiled by state-controlled mortgage lender FHB Bank finally gives a pretty easy-to-use snapshot of Budapest home prices – including bid and offer – not only broken down by district, but also in some cases by neighbourhood. The results are not necessarily surprising (prices are now almost 40% below where they were at the height of the boom in real terms), but are still welcome – providing you’re not operating under that illusion that your property is worth as much as it was back in 2006.

Burglaries in Budapest – How Safe is my Hungarian Property?

FHB has also joined up with central statistics office KSH and the Interior Ministry to create a new data set on the relative frequency with which properties fall prey to burglars. This is a report that does include some surprises. The data point to Districts II, X and XXIII as those with the highest associated risk, while Districts XII, XIII and XIV have the lowest risk.

In Buda, Districts I, III, XI have below-average burglary rates, while on the Pest side Ferencváros, Újpest, Káposztásmegyer and Zugló are among the safest parts. Overall, the worst-affected areas are revealed to be in North Buda, specifically Kőbánya, Felsőrákos, Kispest and Soroksár.

Oddly enough, the correlation between price and crime seems to be pretty random, with the average per-square metre price of property in hard-hit District II over HUF 380,000, almost twice that for similarly at risk X and XXIII. Also note that this does not take into account whatever transaction masking may be in operation when properties are bought or sold. Under the table cash top-ups are as controversial an issue as ever.

Click here to see Budapest property values by map.